Some Known Factual Statements About Advisor Financial Services

Wiki Article

Advisors Financial Asheboro Nc for Beginners

Table of Contents3 Simple Techniques For Financial Advisor RatingsFascination About Advisor Financial ServicesFinancial Advisor Meaning Fundamentals ExplainedA Biased View of Financial Advisor Certifications

There are several kinds of monetary advisors around, each with varying credentials, specializeds, as well as levels of responsibility. As well as when you're on the search for an expert matched to your demands, it's not uncommon to ask, "How do I recognize which economic consultant is best for me?" The solution begins with an honest bookkeeping of your requirements and a bit of study.Kinds of Financial Advisors to Think About Depending on your monetary demands, you might decide for a generalised or specialized financial consultant. As you start to dive into the world of seeking out an economic expert that fits your requirements, you will likely be provided with lots of titles leaving you asking yourself if you are contacting the best person.

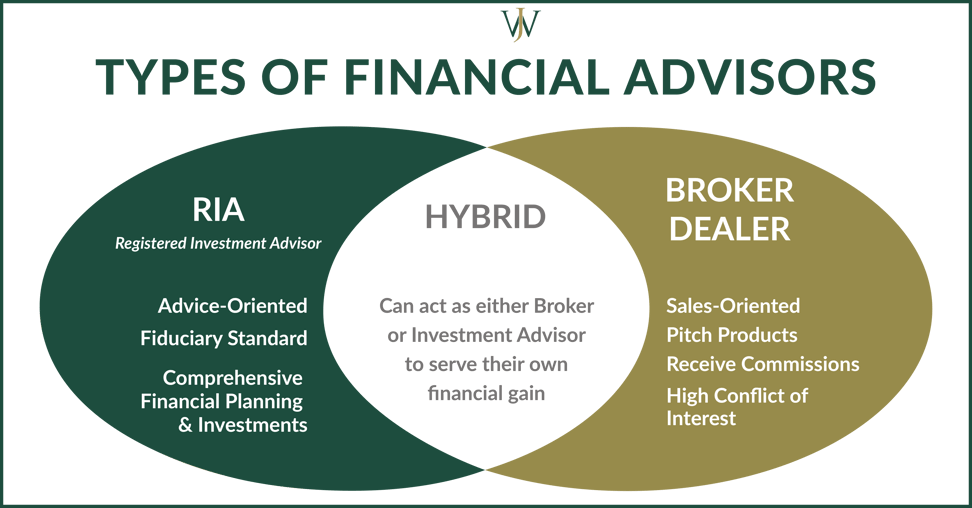

It is necessary to keep in mind that some economic advisors also have broker licenses (definition they can offer securities), however they are not exclusively brokers. On the very same note, brokers are not all certified just as and also are not economic advisors. This is just one of the several factors it is best to begin with a certified monetary coordinator that can encourage you on your financial investments and retired life.

All About Financial Advisor Meaning

Unlike financial investment consultants, brokers are not paid straight by clients, rather, they earn payments for trading stocks and bonds, as well as for selling common funds as well as various other products.

A certified estate organizer (AEP) is an advisor who specializes in estate preparation. When you're looking for an economic advisor, it's great to have a suggestion what you desire help with.

Just like "economic advisor," "monetary coordinator" is likewise a broad term. Someone keeping that title can additionally have other accreditations or specializeds. No matter of your details needs and financial circumstance, one criteria you need to highly consider is whether a prospective advisor is a fiduciary. It might stun you to find out that not all financial advisors are required to act in their clients' benefits.

Advisors Financial Asheboro Nc Fundamentals Explained

To shield yourself from a person who is just attempting to get even more cash from you, it's a great suggestion to look for an advisor who is registered as a fiduciary. A monetary advisor that is signed up as a fiduciary is needed, by regulation, to act in the most effective rate of interests of a customer.Fiduciaries can only suggest you to use such items if they assume it's in fact the best monetary decision for you to do so. The United State Stocks as well as Exchange Payment (SEC) controls fiduciaries. Fiduciaries that fall short to act in a client's benefits can be struck with fines and/or imprisonment of as much as one decade.

That isn't since any person can obtain them. Obtaining either qualification calls for someone to go with a selection of courses and also examinations, in addition to earning a set amount of hands-on experience. The result of the certification procedure is that CFPs as well as Ch, FCs are well-versed in topics across the area of individual money.

As an example, the charge could be 1. 5% for AUM in between $0 as well as $1 million, but 1% for all possessions over $1 million. Costs normally reduce as AUM increases. An expert that generates income only from this administration charge is a fee-only advisor. The choice is a fee-based consultant. They appear comparable, but there's find out an essential distinction.

Indicators on Financial Advisor Job Description You Need To Know

A consultant's administration fee may or more may not cover the costs connected with trading safeties. Some experts additionally bill an established charge per transaction.

This is a service where the advisor will pack all account monitoring expenses, including trading fees as well as expenditure proportions, into one detailed charge. Due to the fact that this charge covers a lot more, it is normally greater than a cost that just includes management and also omits things like trading expenses. Wrap fees are appealing for their simplicity however additionally aren't worth the cost for every person.

They likewise charge costs that are well listed you can find out more below the expert costs from standard, human advisors. While a traditional expert normally charges a cost between 1% and also 2% of AUM, the cost for a robo-advisor is normally 0. 5% or much less. The large compromise with a robo-advisor is that you often do not have the capability to chat with a human consultant.

Report this wiki page